puerto rico tax incentive act

The first is Puerto Ricos Act 20 known as the Export Services Act available to citizens of any country. Act 27 Incentives 4 Fixed income tax rate on development preproduction production and post-production income 1 Fixed Income Tax Rate for pioneer or novel product manufacture 12.

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Corporate - Tax credits and incentives.

. Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act. With the Act 60 Export Services Tax Incentive formerly Act 20 it may only have to pay 4 corporate income tax. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent.

27 of 2011 as amended known as the Puerto Rico Film Industry Economic Incentives Act the Act to solidify its position as one of the. The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019. Make Puerto Rico Your New Home.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Act 20 Puerto Rico Tax Incentives. 4 Fixed Income Tax Rate on Income related to export of services or goods.

On January 17 2012 Puerto Rico enacted Act No. The Act provides the following benefits. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS Contact.

It means that under Puerto Rico Incentives Code 60 if an individual is granted Puerto Rico tax exemption under the act long term gains as a result of investments made after becoming a. 0 US Federal Income Tax. 20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the creation of a.

In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island. Last reviewed - 21 February 2022. 100 Tax Exemption on Income Tax Rate from.

The Torres CPA Group works diligently to ensure you understand all of the laws regarding your Puerto Rico. 4 income tax on industrial development income 0 to 1 tax rate on income for pioneer or novelty products manufactured in Puerto Rico Up to 50. Export Services Tax Incentive For Businesses Business owners who establish a qualifying business in Puerto Rico can enjoy significant tax benefits.

4 corporate tax rate. Qualified businesses can also receive a 100 tax exemption. On March 4 2011 Puerto Rico enacted Act No.

View the benefits of allowing us to manage your Puerto Rican tax incentives. It allows you to slash your corporate tax rate to only 4.

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

How Entrepreneurs Can Save On Taxes In Puerto Rico

Discover Act 60 And Its Tax Incentives For Moving Your Business To Puerto Rico Approved Freight Forwarders

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Act 60 Puerto Rico Science Technology Research Trust

More Biotechs Attracted To Puerto Rico Bioprocess Insiderbioprocess International

Puerto Rico Tax Incentives Act 20 22 Delerme Cpa

Tax Incentive For Research Or Scientists Formerly Act 14 Torres Cpa

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Puerto Rico Tax Incentives Ricardo Casillas

Tax Benefits Puerto Rico S Strategic Location Status As A Us Jurisdiction And Generous Tax Incentives Make It An Ideal Base For Entities That Provide Ppt Download

Puerto Rico Tax Incentives Act 120 Act 135 Act 14 Act 74

Let S Move To Puerto Rico No Capital Gains Tax R Amcstock

Puerto Rico Incentives Code Department Of Economic Development And Commerce

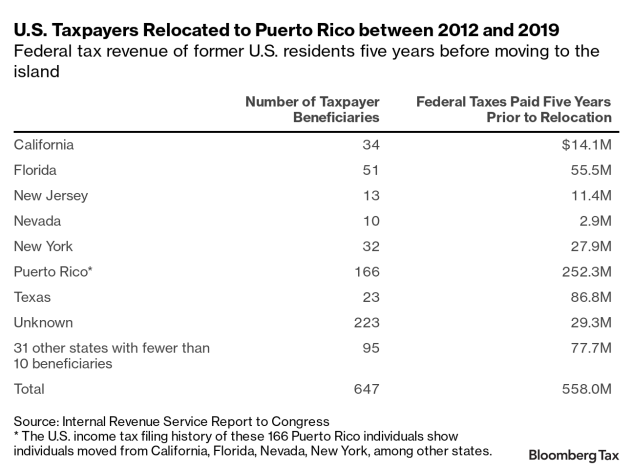

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Tax Policy Helped Create Puerto Rico S Fiscal Crisis Tax Foundation

Tax Benefits Puerto Rico S Strategic Location Status As A Us Jurisdiction And Generous Tax Incentives Make It An Ideal Base For Entities That Provide Ppt Download

The Downside Of Puerto Rico S Insanely Great Tax Incentives Sovereign Research